The “Woolhouse method” or “Woolhouse approximation” is a well-known method for simplifying the evaluation of annuities that are paid more frequently than annually. A plethora of information about Woolhouse is available on the internet, but here is an elegant demonstration of this method.

Assume that the following are linear functions of 𝑡 for integral age 𝑥 and 0 ≤ 𝑡 ≤ 1:

|

• |

|

obviously |

|

• |

|

this is the UDD assumption |

|

• |

|

this is the Balducci hypothesis |

It follows that

if ![]() ,

, ![]() , and

, and ![]() are linear

functions of 𝑡,

then

are linear

functions of 𝑡,

then ![]() ,

, ![]() , and

, and ![]() are linear functions of 𝑡 as well. This produces

the

are linear functions of 𝑡 as well. This produces

the ![]() shortcut.

A proof of this method is provided

below.

shortcut.

A proof of this method is provided

below.

Proof of the ![]() shortcut

shortcut

Assuming that ![]() is a linear

function of 𝑡 for

integral age 𝑥 and 0 ≤ 𝑡 ≤ 1, we evaluate

is a linear

function of 𝑡 for

integral age 𝑥 and 0 ≤ 𝑡 ≤ 1, we evaluate ![]() using a straight line interpolation between

using a straight line interpolation between ![]() and

and ![]() , hence:

, hence:

![]() for

integral 𝑥 and

0 ≤ 𝑡 ≤ 1

for

integral 𝑥 and

0 ≤ 𝑡 ≤ 1

Since 𝑣00𝑝𝑥 =

1, this equation is simplified to:

![]()

Substituting ![]() for 𝑡 in the above

formula, we get the following formula which will be used in Formula 1

for this proof:

for 𝑡 in the above

formula, we get the following formula which will be used in Formula 1

for this proof:

|

|

Formula

2 |

The present value of a life annuity can then be expressed as:

![]()

where 𝑃𝑉𝑌𝑒𝑎𝑟𝑥 is the present value at age 𝑥 of the 𝑚 payments to be paid during the year, and

![]()

Because we have linear ![]() for 0 ≤ 𝑡 ≤ 1,

then the 𝑚 payments are an arithmetic series, where the

sum of an arithmetic series is found by multiplying

the number of terms times the average of the first and last terms.

𝑃𝑉𝑌𝑒𝑎𝑟𝑥 is summed as follows:

for 0 ≤ 𝑡 ≤ 1,

then the 𝑚 payments are an arithmetic series, where the

sum of an arithmetic series is found by multiplying

the number of terms times the average of the first and last terms.

𝑃𝑉𝑌𝑒𝑎𝑟𝑥 is summed as follows:

By substituting using Formula 2, this becomes:

![]()

And if we simplify and rearrange terms we get:

![]()

Then we have:

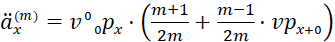

|

|

Formula 2.1 |

Which can be simplified to obtain the desired result:

|

|

Formula

2.2 |

|

|

Formula

2.3 |

|

|

Formula

2.4 |

|

|

Formula

2.5 |

Using this method, we have an 𝑚 times

speed improvement, because we need only calculate the present value of an

annuity with annual payments and then make the (𝑚 – 1)/2𝑚 adjustment.

Note that if an

annuity is temporary or deferred, or if the interest rate changes from one year

to the next, then we do not have the convenient simplification happening when

we go from Formula 2.1 to Formula 2.2!

For example:

·

for a 𝑛-year deferred life annuity

with payments made 𝑚 times per year, it

can be shown that:

![]()

·

for a 𝑛-year temporary life annuity with payments made 𝑚 times per

year, it can be shown that:

![]()