A single life annuity is a series of periodic payments continuing throughout a single person's lifetime.

Types of single life annuities

To get detailed information about a specific type of single life annuity, click its name in the first column.

|

Type

of Annuity |

Description |

|

A life annuity for a single

life. |

|

|

A life annuity with deferred

commencement of payments. |

|

|

A life annuity with temporary

payments. |

|

|

A life annuity with payments for a

guaranteed period. |

|

|

A period certain life annuity with deferred

commencement of payments. |

|

|

A life annuity with a

provision that upon death, an amount will be paid in a lump sum equal to the

excess, if any, of the present value of the annuity at the time of

commencement, over the sum of the annuity payments received prior to death. |

|

|

A life annuity that provides

an initial payment amount that is subsequently adjusted to a lower amount at

a later age; typically, the benefit amounts are coordinated with a Social

Security benefit. |

General formula

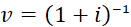

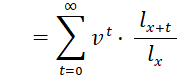

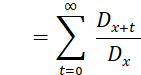

The present value at age 𝑥 of a life annuity of 1 per year, payable at the beginning of the year is calculated by this formula:

![]()

Where

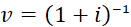

· the interest discount rate is

![]()

·

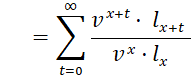

the probability of survival

from age 𝑥 to age 𝑥 + 𝑡 is

![]()

·

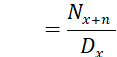

![]() the

number of lives surviving to age 𝑥 in a population of

the

number of lives surviving to age 𝑥 in a population of ![]() lives at age 0

lives at age 0

For simplicity, the upper limit of the summation is infinity because the probability of survival becomes zero at age 𝜔 (omega), the terminal age in mortality table.

A single life annuity may have specific provisions including:

· payments made more frequently that annually

· methods for fractional ages

A life annuity is a series of periodic payments that continues until death.

The present value at age 𝑥 of a life annuity of 1 per year, payable at the beginning of the year is calculated by this formula:

![]()

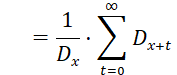

Using commutation functions, the present value formula for a single life annuity is:

![]()

If payments are made more frequently than annually, adjustments are made based on certain simplifying assumptions.

A life annuity with a deferred commencement.

The present value at age 𝑥 of an n-year deferred life annuity is calculated by the formula:

A life annuity with payments that end after a temporary period or at death, whichever comes first.

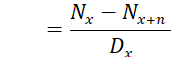

The present value at age 𝑥 of an n-year temporary life annuity is calculated by the formula:

![]()

Excel functions

Click here

to see the various Excel functions to handle single life annuities.

A life annuity with a guaranteed number of payments. This is calculated as the sum of a period certain annuity plus a deferred life annuity.

The present value at age 𝑥 of an n-year period certain annuity is calculated by the formula:

![]()

![]()

![]()

![]()

Excel functions

Click here

to see the various Excel functions to handle single life annuities.

Deferred period

certain life annuity

A period certain life annuity with a deferred commencement.

The present value at age 𝑥 of an n-year deferred m-year period certain annuity is calculated by the formula:

![]()

|

Note: |

The

payments during the certain period are contingent upon survival from the

current age 𝑥 to the commencement age 𝑥 + 𝑛. |

Excel functions

Click here

to see the various Excel functions to handle single life annuities.

A cash refund annuity is a life annuity with a provision that at the time of death, an amount will be paid in a lump sum equal to the excess, if any, of the present value of the annuity at the time of commencement, over the sum of the annuity payments received prior to death.

The present value is calculated as a life annuity plus a death benefit that is a decreasing life insurance. The initial amount of the life insurance is present value of the cash refund annuity, decreasing by the sum of the annuity benefits paid in total from commencement through the time of death.

PV of CRA = PV of life annuity + PV of death benefit

This is a complex calculation because the initial death benefit amount is equal to PV CRA, therefore we must use an iterative process to determine 𝐺 as follows:

![]()

Where:

![]() present value of a cash refund

annuity.

present value of a cash refund

annuity.

![]() present

value of a life annuity.

present

value of a life annuity.

![]() present value of temporary

life insurance

with a term of 𝑛 years.

present value of temporary

life insurance

with a term of 𝑛 years.

![]() present value of increasing

life insurance

with a term of 𝑛 years.

present value of increasing

life insurance

with a term of 𝑛 years.

![]() the term of the death

benefit, equals 𝐺 by definition.

the term of the death

benefit, equals 𝐺 by definition.

Solving for 𝐺 we have:

Through an iterative process, determine 𝑛 such that 𝑛 = 𝐺.

Excel functions

Click here

to see the various Excel functions to handle single life cash refund annuities.

A level income annuity is a life annuity with that provides an initial payment amount that is subsequently adjusted to a lower amount at a later age; typically, the benefit amounts are coordinated with a Social Security benefit.

The present value is calculated

as a temporary life annuity plus a deferred

life annuity.

![]() (𝐵𝑒𝑛1 · 𝑛-year

temporary annuity) + (𝐵𝑒𝑛2 · 𝑛-year deferred

annuity)

(𝐵𝑒𝑛1 · 𝑛-year

temporary annuity) + (𝐵𝑒𝑛2 · 𝑛-year deferred

annuity)

where

![]() Social

Security benefit starting 𝑛 years after commencement

Social

Security benefit starting 𝑛 years after commencement

![]() is

the amount payable for the first 𝑛 years

is

the amount payable for the first 𝑛 years

![]() is

the amount payable starting 𝑛 years after commencement

is

the amount payable starting 𝑛 years after commencement

![]()

![]()

![]()

![]()

![]()

If we let

![]()

then present value at age 𝑥

of a life annuity of 1 per year, payable at the beginning of the year, for 𝑛

years, dropping to 𝐹 per year thereafter, is

calculated by this formula:

![]()

Excel functions

Click

here to see the

various Excel functions to handle single life level income annuities.