Life insurance is a payment contingent upon the death of an insured life.

General formula

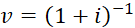

The present value at age 𝑥 of a life insurance with a payment of 1, paid at the end of the year of death is calculated by this formula:

![]()

Types of life insurances

To get detailed information about a specific type of life insurance, click its name in the first column.

|

Type

of Annuity |

Description |

|

Life insurance |

A payment contingent upon the death of an insured life. |

|

A payment contingent upon the first death of two insured lives. |

|

|

An insurance which provides a payment only if death

occurs within a limited number of years |

|

|

An insurance which provides a payment only if death

occurs after a number of years. |

|

|

An insurance which provides a death benefit that

increases by 1 with each passing year. |

|

|

An insurance which provides a death benefit that increases by 1 with each passing year, with no death benefit paid if death does not occur within a limited number of years. |

|

|

A decreasing life insurance provides an initial death

benefit of 𝑛 decreasing by 1 with each

passing year. If death occurs after 𝑛 years then no

payment is made. |

A payment contingent upon the death of an insured life.

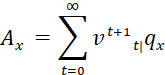

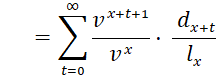

The present value at age 𝑥 of a life insurance with a payment of 1, paid at the end of the year of death is calculated by this formula:

![]()

where

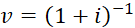

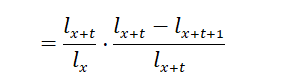

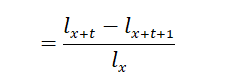

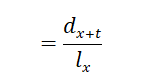

· the interest discount is

![]()

· ![]() probability that (𝑥) will survive to age 𝑥 + 𝑡 and die within 1 year

probability that (𝑥) will survive to age 𝑥 + 𝑡 and die within 1 year

·

![]() the

number of lives surviving to age 𝑥 in a population of

the

number of lives surviving to age 𝑥 in a population of ![]() lives at age 0

lives at age 0

·

![]() the

number of lives at age 𝑥 who die before the attainment of age 𝑥 + 1

the

number of lives at age 𝑥 who die before the attainment of age 𝑥 + 1

For simplicity, the upper limit of the summation is infinity because the probability of survival becomes zero at age 𝜔 (omega), the terminal age in mortality table.

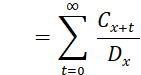

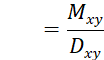

Using commutation functions, the present value formula of life insurance is:

![]()

If the payment is made prior to the end of the year, adjustments

are made based on certain simplifying assumptions.

A payment contingent upon the first death of two insured lives 𝑥 and 𝑦.

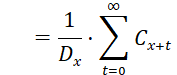

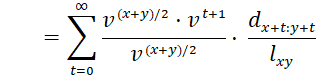

The present value at joint age (𝑥𝑦) of a joint life insurance with a payment of 1, paid at the end of the year of the first death of either 𝑥 or 𝑦 is calculated by this formula:

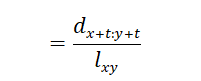

![]()

where

· the interest discount is

![]()

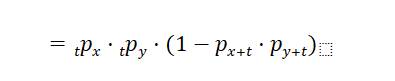

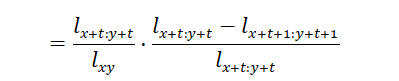

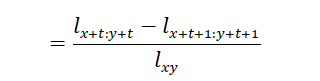

· ![]() probability that both 𝑥 and 𝑦 survive 𝑡 years to ages 𝑥 + 𝑡: 𝑦 + 𝑡, and one or both die within 1 year after that:

probability that both 𝑥 and 𝑦 survive 𝑡 years to ages 𝑥 + 𝑡: 𝑦 + 𝑡, and one or both die within 1 year after that:

·

![]()

·

![]()

For simplicity, the upper limit of the summation is infinity because the probability of survival becomes zero at age 𝜔 (omega), the terminal age in mortality table.

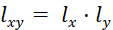

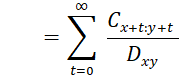

Using commutation functions, the present value formula of life insurance is:

![]()

where

![]()

![]()

Term insurance (temporary life

insurance)

An insurance which provides a payment only if death occurs within a limited number of years.

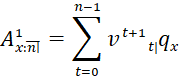

The present value at age 𝑥 of an n-year term insurance is calculated by the formula:

![]()

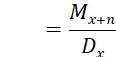

An insurance which provides a payment only if death occurs after a number of years.

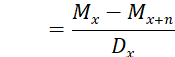

The present value at age 𝑥 of an n-year deferred insurance is calculated by the formula:

![]()

An increasing life insurance provides a death benefit that increases by 1 with each passing year.

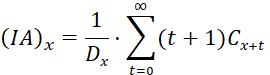

The present value at age 𝑥 of an increasing insurance is calculated by the formula:

![]()

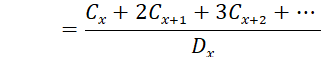

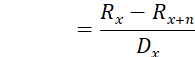

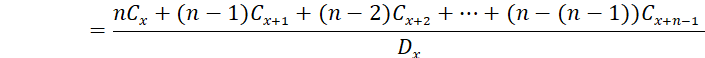

Using commutation functions, the present value formula of an increasing life insurance is:

![]()

![]()

![]()

An increasing term insurance provides a death benefit that increases by 1 with each passing year, with no death benefit paid if death does not occur within a limited number of years.

The present value at age 𝑥 of an increasing term insurance is calculated by the formula:

![]()

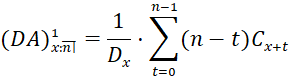

A decreasing life insurance provides an initial death benefit of 𝑛 decreasing by 1 with each passing year. If death occurs after 𝑛 years then no payment is made.

The present value at age 𝑥 of a decreasing insurance is calculated by the formula:

![]()

Using commutation functions, the present value formula of a decreasing life insurance is:

![]()

![]()

![]()

![]()

![]()

Excel functions

Click here

to see the various Excel functions to handle life insurance.