A joint

life annuity is a series of periodic payments contingent on the lifetime of

two (or more) lives, where the payment amount can vary depending on if only 𝑥

is alive, or if only 𝑦 is alive, or

if both 𝑥

and 𝑦 are alive.

Types of joint life annuities

To get detailed information about a specific type of joint life annuity, click its name in the first column.

|

Type

of Annuity |

Description |

|

An annuity payable during the joint lifetime of 𝑥 and 𝑦, with a provision that

upon the first death, a percentage of the original amount is payable during

the remaining lifetime of the survivor, regardless of who dies first. |

|

|

An annuity payable during the joint lifetime of 𝑥 and 𝑦, with the provision

that: ·

if 𝑦 dies first, then the

original amount is payable during the remaining lifetime of 𝑥. ·

if 𝑥 dies first, then a

percentage of the original amount is payable during the remaining lifetime of

𝑦. |

|

|

A joint & survivor annuity, with a provision

that upon the death of 𝑦

while 𝑥

is alive, the payment amount to 𝑥 "pops up" to a

given amount for the remaining lifetime of 𝑥. |

|

|

An annuity payable during the lifetime of 𝑦, with payments

beginning upon the death of 𝑥. |

|

|

An annuity payable during the joint lifetime of 𝑥 and 𝑦, with payments

stopping upon the first death, regardless of who dies first. |

|

|

A joint & survivor annuity with payments for the

remainder (if any) of a guaranteed period after the death of both 𝑥 and 𝑦. |

General formula

The present value of a joint & survivor annuity for two lives at ages 𝑥 and 𝑦 is:

![]()

where

![]() benefit amount payable while both 𝑥 and 𝑦 are alive

benefit amount payable while both 𝑥 and 𝑦 are alive

![]() benefit amount payable to 𝑥 after the death of 𝑦

benefit amount payable to 𝑥 after the death of 𝑦

![]() benefit amount payable to 𝑦 after the death of 𝑥

benefit amount payable to 𝑦 after the death of 𝑥

and

![]() present value of a life

annuity payable to 𝑥

present value of a life

annuity payable to 𝑥

![]() present

value of a life annuity payable to 𝑦

present

value of a life annuity payable to 𝑦

![]() present

value of a joint life annuity payable to 𝑥 and 𝑦

present

value of a joint life annuity payable to 𝑥 and 𝑦

A joint & survivor annuity is a series of periodic payments during the joint lifetime of 𝑥 and 𝑦, with a provision that upon the first death, a percentage of the original amount is payable during the remaining lifetime of the survivor, regardless of who dies first.

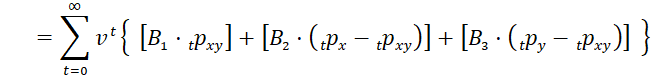

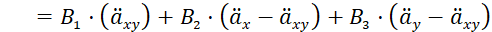

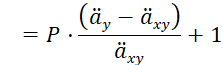

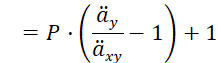

The present value at ages 𝑥 and 𝑦 of a 𝑃% joint & survivor annuity of 1 per year, payable at the beginning of the year is calculated by the general formula:

![]()

with

![]()

![]()

![]()

hence the present value is calculated

by this formula:

![]()

![]()

Note these special cases:

·

For a 100% joint &

survivor annuity, 𝑃

= 1 thus

![]()

·

For a 50% joint &

survivor annuity, 𝑃

= .5 thus

![]()

Contingent joint & survivor annuity

A contingent joint & survivor annuity is a series of periodic payments during the joint lifetime of 𝑥 and 𝑦, with the provision that:

·

if 𝑦 dies

first, then the original amount is payable during the remaining lifetime of 𝑥.

· if 𝑥 dies first, then a percentage of the original amount is payable during the remaining lifetime of 𝑦.

The present value at ages 𝑥 and 𝑦 of a 𝑃% contingent joint & survivor annuity of 1 per year, payable at the beginning of the year is calculated by the general formula:

![]()

with

![]()

![]()

![]()

hence the present value is calculated by this formula:

![]()

![]()

A pop-up annuity is a joint & survivor annuity, with a provision that:

·

if 𝑦 dies

first, then the amount payable to 𝑥 "pops up" to a

higher amount, typically the amount of benefit payable to 𝑥 benefit

before a reduction for actuarial equivalence.

· if 𝑥 dies first, then a percentage of the original amount is payable during the remaining lifetime of 𝑦.

The present value at ages 𝑥 and 𝑦 of a 𝑃% pop-up annuity of 1 per year, payable at the beginning of the year is calculated by the general formula:

![]()

with

![]()

![]()

![]()

and

![]() the

pop-up benefit amount payable to 𝑥

upon the death of 𝑦

the

pop-up benefit amount payable to 𝑥

upon the death of 𝑦

In theory, 𝐵 could be anything, but in

practice we assume that 𝐵

equals the benefit amount that would be payable to 𝑥 in the event that 𝑥 had not elected a 𝑃% joint & survivor annuity.

![]()

hence the present value is

calculated by this formula:

![]()

![]()

![]()

![]()

![]()

![]()

Furthermore, the pop-up benefit 𝐵 is calculated by this formula:

![]()

Small modifications will be made to this formula if the normal form of benefit is something other than a straight life annuity.

A reversionary

joint annuity is a series of periodic payments where nothing is

paid during the joint lifetime of 𝑥

and 𝑦, and:

·

if 𝑦 dies first, then payments made during the remaining

lifetime of 𝑥.

·

if 𝑥 dies first, then nothing is paid.

The present value at ages 𝑥 and y of a reversionary annuity of 1 per year, payable at the beginning of the year is calculated by the general formula:

![]()

with

![]()

![]()

![]()

hence the present value is

calculated by this formula:

![]()

A joint annuity is a series of periodic payments payable during the joint lifetime of 𝑥 and 𝑦, with payments stopping upon the first death, regardless of who dies first.

The present value at ages 𝑥 and 𝑦 of a joint annuity of 1 per year, payable at the beginning of the year is calculated by the general formula:

![]()

with

![]()

![]()

![]()

hence the present value is calculated by this formula:

![]()

Period certain joint & survivor annuity

The present value of a joint & survivor annuity with 𝑛-years certain for two lives at ages 𝑥 and 𝑦 is:

![]()

![]()

![]()

![]()

where

![]() benefit amount payable while both 𝑥 and 𝑦 are alive

benefit amount payable while both 𝑥 and 𝑦 are alive

![]() benefit amount payable to 𝑥 after the death of 𝑦

benefit amount payable to 𝑥 after the death of 𝑦

![]() benefit amount payable to 𝑦 after the death of 𝑥

benefit amount payable to 𝑦 after the death of 𝑥

![]() benefit amount payable for the remainder (if any) of the 𝑛-year

certain

period after the death of both 𝑥

and 𝑦

benefit amount payable for the remainder (if any) of the 𝑛-year

certain

period after the death of both 𝑥

and 𝑦

and

![]() present

value of a life annuity payable to 𝑥

present

value of a life annuity payable to 𝑥

![]() present

value of a life annuity payable to 𝑦

present

value of a life annuity payable to 𝑦

![]() present

value of a joint life annuity payable to 𝑥 and 𝑦

present

value of a joint life annuity payable to 𝑥 and 𝑦

![]() present

value of an 𝑛-year period certain annuity

present

value of an 𝑛-year period certain annuity

![]() present

value of an 𝑛-year temporary life annuity payable to 𝑥

present

value of an 𝑛-year temporary life annuity payable to 𝑥

![]() present

value of an 𝑛-year temporary life annuity payable to 𝑦

present

value of an 𝑛-year temporary life annuity payable to 𝑦

![]() present

value of an 𝑛-year temporary joint life annuity payable to 𝑥 and 𝑦

present

value of an 𝑛-year temporary joint life annuity payable to 𝑥 and 𝑦

Excel functions

Click here to see the various Excel functions to handle joint life annuities.