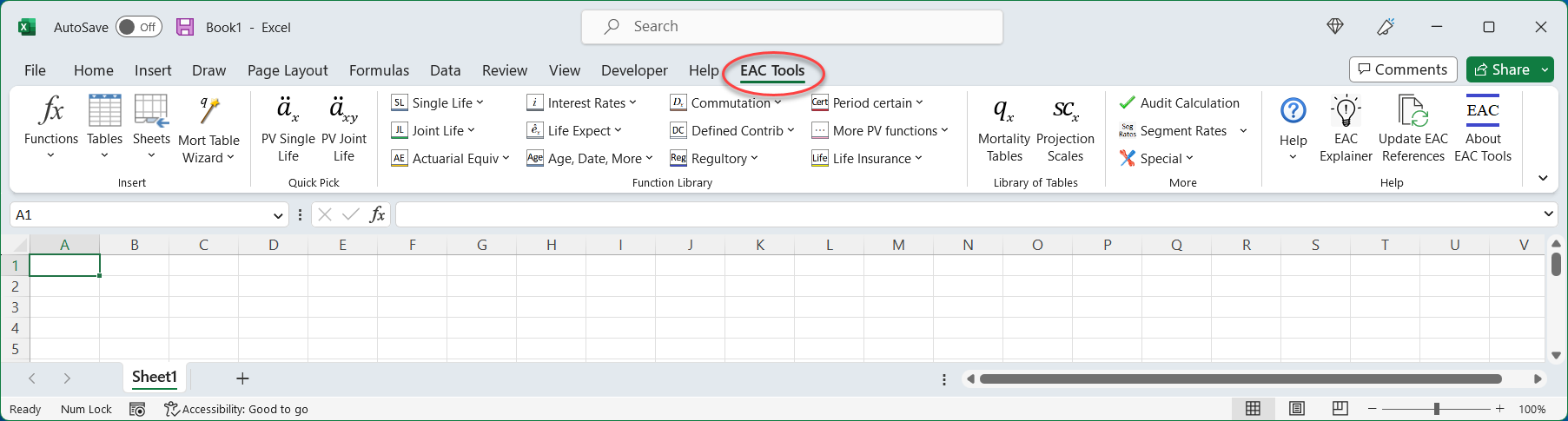

The EAC Tools add-in inserts itself into Excel’s main menu, "The Ribbon", and literally becomes an integral part of Excel. There you will find a very large collection of worksheet functions and macros that produce a wide variety of pre-formatted tables, and entire sheets that produce useful results. The worksheet functions are used just like any other Excel function, providing the user with a comprehensive collection of calculations. From the main menu, a user can click on buttons to:

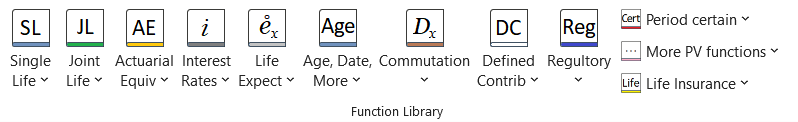

EAC Tools contains a large collection of Excel functions for:

Examples of functions, macros, tables, and sheets are shown in screen shots below.

- insert functions into the active cell.

- paste pre-formatted tables into the active worksheet.

- insert sheets in the active workbook.

EAC Tools contains a large collection of Excel functions for:

- Actuarial present value of annuities.

- Life insurance.

- Life expectancy.

- Actuarial equivalence.

- Commutation functions.

- Other mortality table functions.

- Defined contribution plan functions (not available in the Basic Version).

- IRS annual limits and other key regulatory values for benefit plans published by the IRS, the Social Security Administration, and the PBGC (not available in the Basic Version). Click here for more information of these items.

- The add-in also includes several worksheet "macros" that can be used to paste a function into a sheet, or to paste an entire table into a sheet, or to insert an entire sheet into a workbook. Examples of functions, macros, tables, and sheets are shown here.

Examples of functions, macros, tables, and sheets are shown in screen shots below.

The user-defined functions in EAC Tools can be entered just like any other Excel formula, that is, press "=" and type the formula. If you haven't memorized the function parameters, there are a few tools you can use for help:

- You can refer to the User's Guide. Click here to view.

- You can enter a function using Excel's "Insert Function" dialog box by clicking on "fx" on the formula bar; or by clicking the "Insert Function" button on the "Formulas Ribbon"; or by pressing Shift-F3. From there, you can click on Excel's "help on this function" just like any other built-in function.

- You can run a macro that displays the parameters (arguments) that are used by the formula with a description of usage. The macros are invoked by clicking "EAC Tools" on Excel's Ribbon.

User Guide

A comprehensive user guide with technical documentation is provided both in Excel and on-line. Click here to view the on-line version of the guide. The user guide is accessible in Excel's "help on this function" in the standard function dialog box. EAC Tools uses a Compiled HMTL (chm) help file that may be restricted by your organizations security policies.

Function Categories

Interest Rates

The interest rate can be entered in various ways:

- Single rate

This is the simplest use of the interest rate assumption – one rate that applies for all time. - Deferred and immediate rates

One or more rates that apply during the deferred period (prior to commencement), and a different rate that applies during payment (after commencement). - Select and ultimate rates

One rate that applies for a given number of years, and a different rate that applies thereafter. - Spot rates

Specific interest rates that are used to discount each future payment. - Forward rates

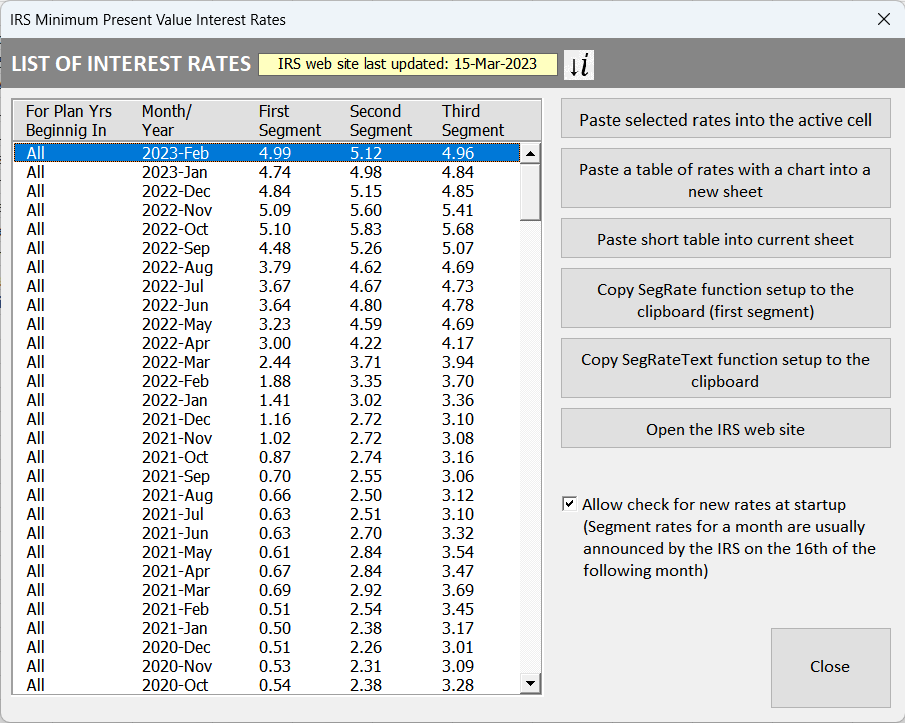

Various rates that apply over time, compounded to discount future payments. - PPA segment rates

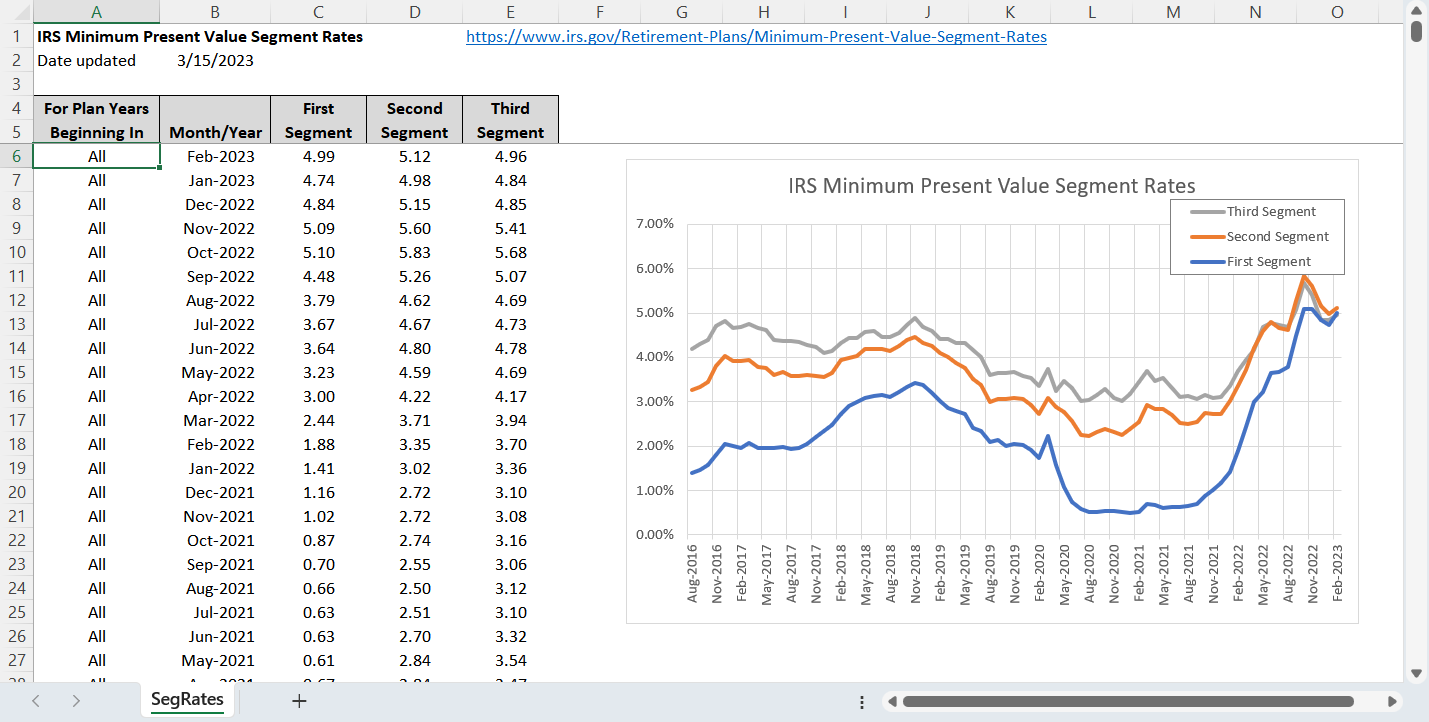

Three “spot rates” that are used to discount future payments, as required by the Pension Protection Act of 2006. Segment rates are downloaded directly from the IRS web site each month.

Mortality Tables

EAC Tools has a large library of mortality tables from various sources including the IRS, Society of Actuaries, PBGC, ERISA, Canadian Institute of Actuaries, American Academy of Actuaries, etc.

- IRS §430(h) static tables

- Disabled

- ERISA

- Group Annuity Mortality (1951, 1971, 1983, 1994)

- Individual Annuity Mortality (1949, 1971, 1983, 2000, 2012)

- Life

- Other (Canadian Pensioners' Mortality, New York City Police, RMD under 401(a)(9), Chile, etc.)

- PBGC

- Pri-2012, Pub-2012

- RP-2000, RP-2006, RP-2014

- Railroad Retirement Board

- Social Security Period Life Tables

- You can also create a user-defined table based on your own mortality rates. The rates can be in a worksheet and used as a reference to range or saved in a text file.

Mortality Improvement

Mortality tables can be projected to a specific year on a static and/or generational basis using various projection scales:

- AA, B, BB, BB2D, C, CPM-B, CPM-B1D, D, E, G2, H, MI2017, MP2014, MP2015, MP2016, MP2017, MP2018, MP2019, MP2020, MP2021, and Chilean.

- You can also create a user-defined mortality improvement scale (1-D or 2-D) based on your own rates. The rates can be saved in a text file.

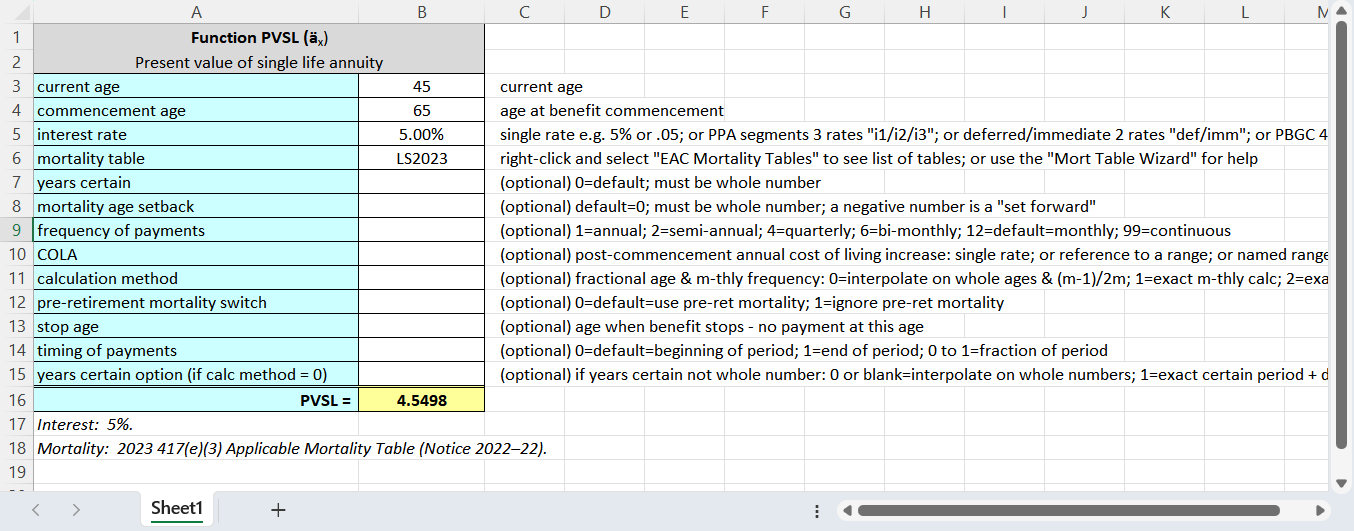

Function Examples

There is a very large collection of functions organized by category in Excel's main menu. Note that "Defined Contribution" and "Regulatory" functions are not available in EAC Tools -- Basic Version. A complete list of all functions is found in the User Guide.

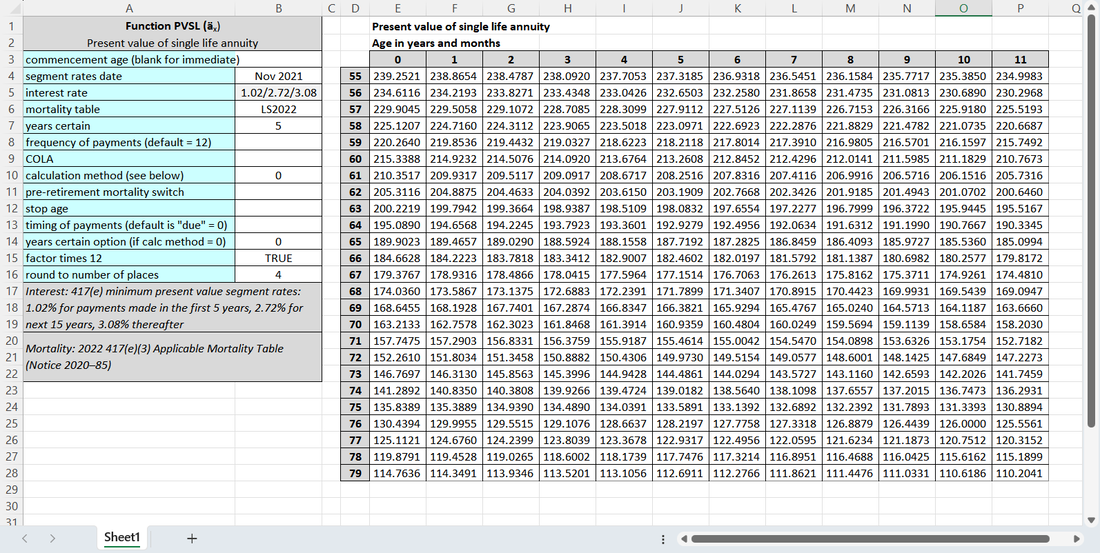

Present value of a single life annuity

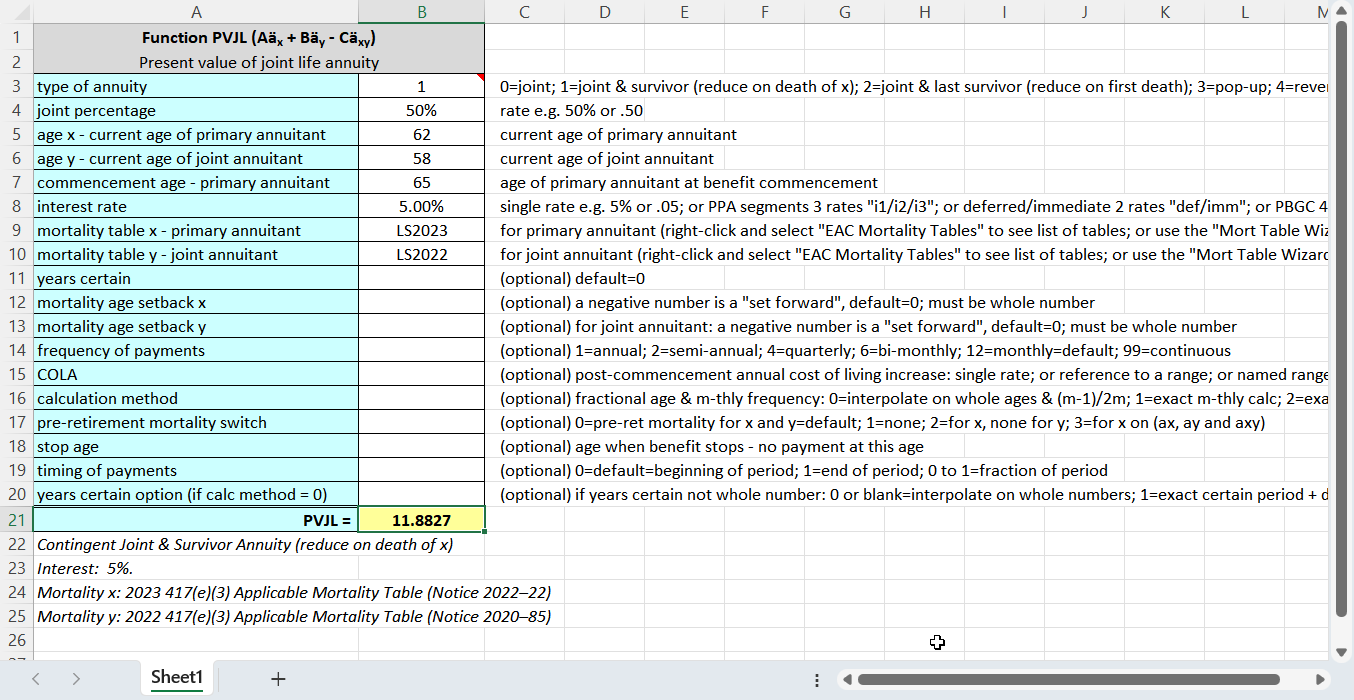

Present value of a joint life annuity

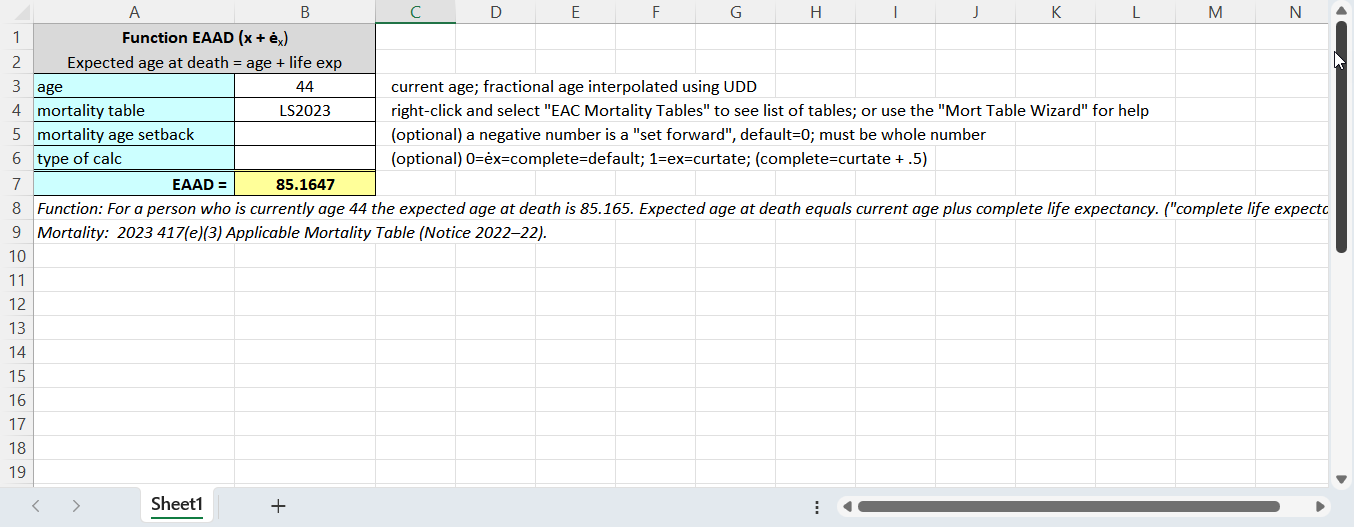

Life expectancy

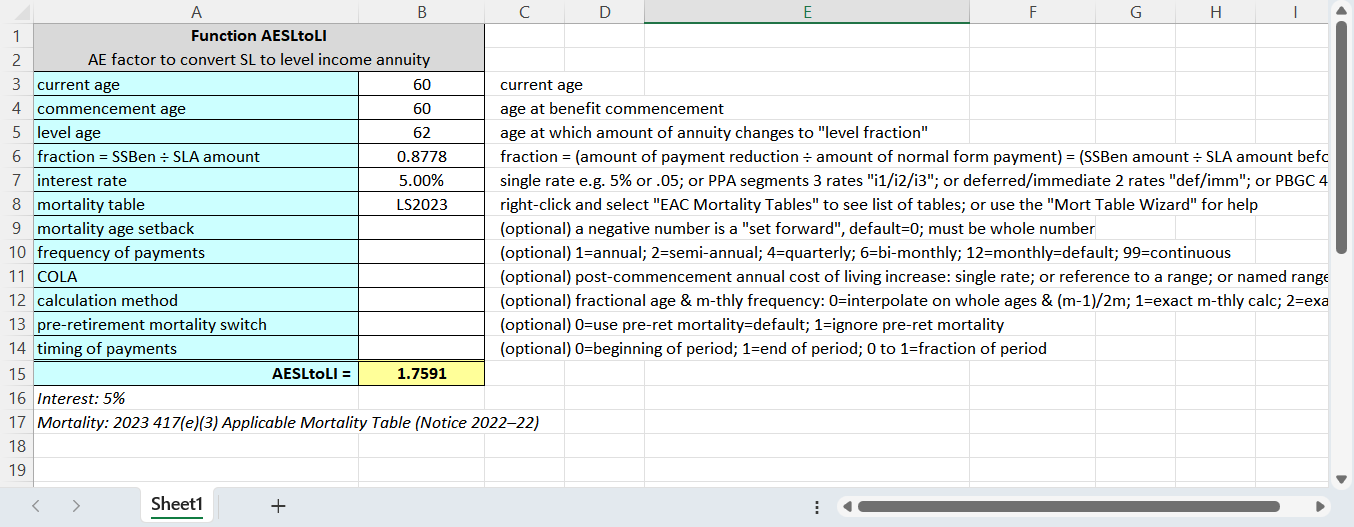

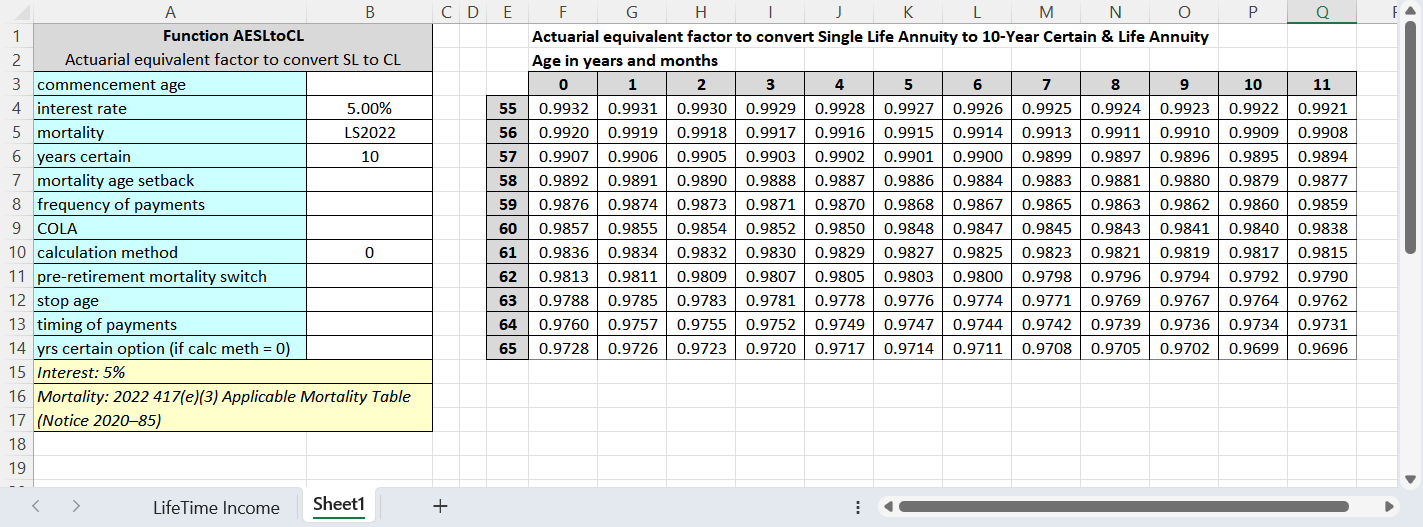

Actuarial equivalent factor to convert SLA to "level income annuity"

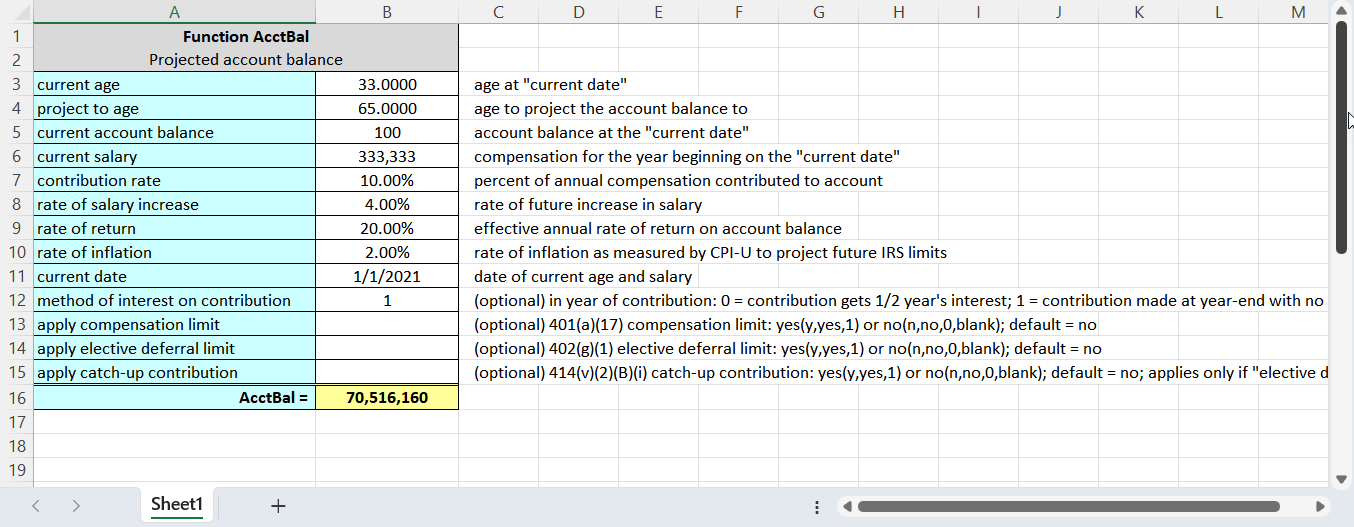

Projected DC account balance

Macro-Generated Table Examples

There is a very large collection of macro-generated tables. Note that "Defined Contribution" and "Regulatory" tables are not available in EAC Tools -- Basic Version. A complete list of all tables is found in the User Guide.

Lump sum factor table

Actuarial equivalence table -- convert SLA to 10-year certain & life

Macro-Generated Sheet Examples

There is a very large collection of macro-generated sheets. Note that "Defined Contribution" and "Regulatory" sheets are not available in EAC Tools -- Basic Version. A complete list of all sheets is found in the User Guide.

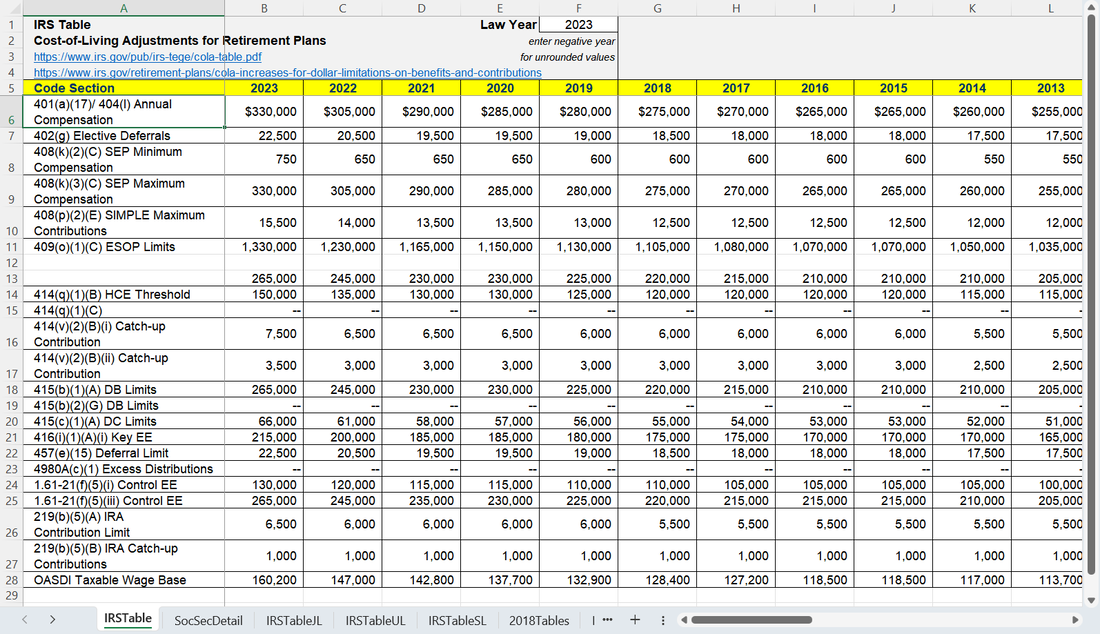

IRS limits

IRS minimum present value segment rates & chart

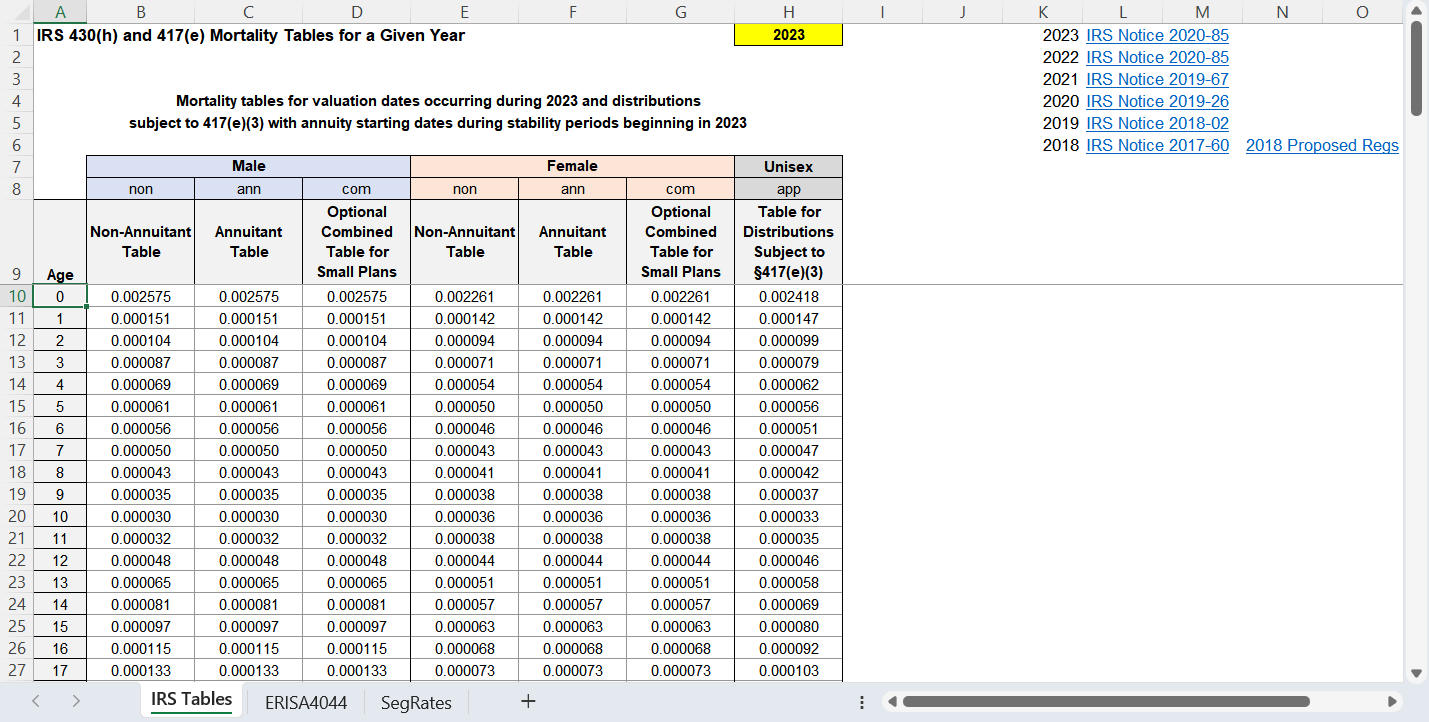

IRS 430(h) and 417(e) mortality tables for a given year

Many other sheets are available. A complete list of all sheets is found in the User Guide.

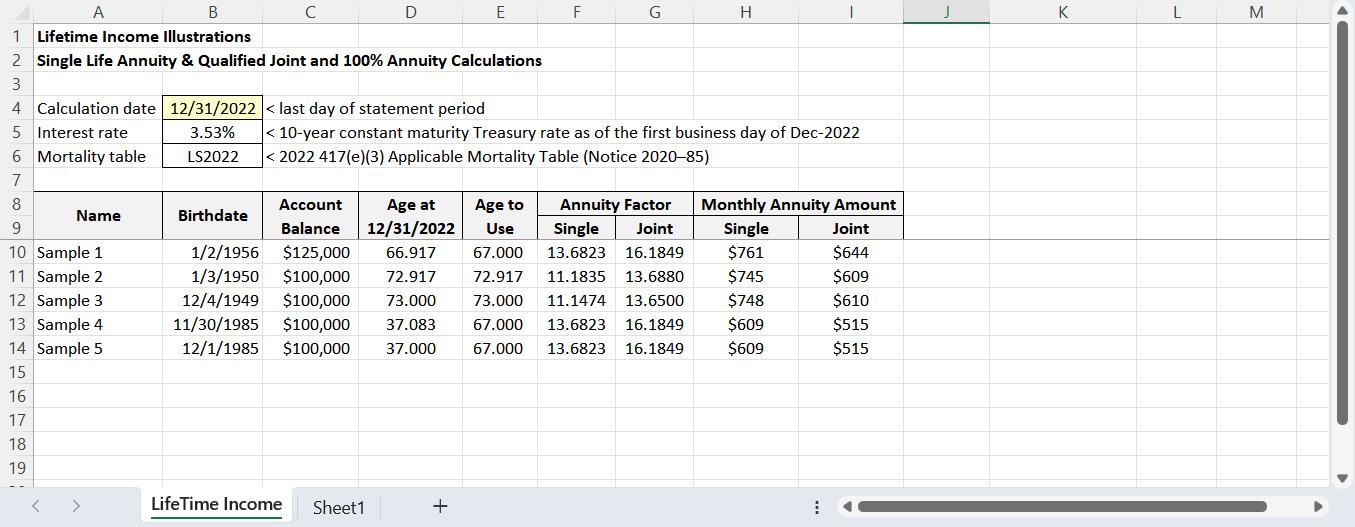

Lifetime Income Illustration Calculation

On August 18, 2020 the Department of Labor announced an interim final rule for defined contribution retirement plans in response to the Setting Every Community Up for Retirement Enhancement Act of 2019 (the SECURE Act). DC plans are required to include two lifetime income illustrations on participants’ pension benefit statement at least once every 12 months. A participant’s account balance is to be converted to a lifetime income equivalent:

- a single life annuity (SLA)

- a qualified joint and survivor annuity (QJSA)