- Added a new mortality improvement scale, 2024 Adjusted Scale MP–2021 Rates, announced by the IRS on October 20, 2023, and published here.

- Added new 2024 IRS static mortality tables:

-- 417(e) lump sum mortality table published in IRS Notice 2023-73.

-- 430(h) static tables (male and female) published in IRS final regulations. - Note that the generational tables mentioned in the final regs already exist in EAC Tools. The "2012 Pri-2012 special base tables" are as follows:

-- IRS2012BASE-ANN-M

-- IRS2012BASE-ANN-F

-- IRS2012BASE-NON-M

-- IRS2012BASE-NON-F

You can use these tables along with the mortality improvement scale of your choice to produce your desired mortality table. - Added September 2023 CPI to produce 2024 regulatory amounts (IRS amounts not announced at this time).

|

0 Comments

Fixed a minor issue with Excel's function dialog box where the parameter descriptors were not displayed properly.

This is another minor update, with an even faster add-in startup upon launching Excel.

This is a minor update to fix an issue where a user reported that opening an existing workbook was going slower than before. This was an issue with a very large file, e.g. a file with worksheets that had a "used range" with over 1 million rows.

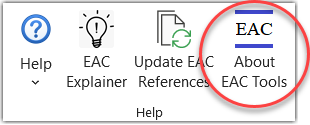

Introducing "EAC Tools"A lot of development has been happening, and we are excited to issue a new release. Here is a summary of changes.

If you currently use only EAC PV Tools ...You will now be using EAC Tools Basic Version.

If you currently use both EAC PV Tools and Utilities ...You will now be using EAC Tools Full Version.

Why the change?There are a few very compelling reasons for this change.

EAC PV Tools (version 2023.1) was updated for the following mortality tables announced by the PBGC:

EAC Utilities (version 2023.1) was updated for the September 2022 consumer price index (CPI-W and CPI-U).

Added 417(e) table for lump sum calculations, and IRS 430(h)(3) static mortality tables for 2023 per IRS Notice 2022-22:

Added new sheet for "Lifetime income illustration". Added new function TRate30IRS that returns the "IRS 30-yr TSR" which may be different from the Federal Reserve 30-year rate that is returned by the TRate30 function. Added audit for PVSLPPA function. Made a minor correction in the PVJL function, when using calculation method 1 or 2, and when using generational mortality improvement ("/gen" option), with a fractional age that, if rounded, would round to the next larger whole integer. Note that this does not affect calculation method 0, 8, or 9, or any other mortality table. If you find that this raises an issue for your calculations, please contact technical support. IRS Notice 2022-22 -- The IRS published this notice today -- Updated Static Mortality Tables for Defined Benefit Pension Plans for 2023. The current version of EAC PV Tools (version 2022.2) has correctly anticipated these tables -- the expected tables are the same as the actual tables -- the methodology for 2023 is the same as the methodology for 2022, so everything works! An update will come, but until then you can continue to use the current version to produce lump sum factors for 2023.

|

Archives

May 2025

|

RSS Feed

RSS Feed