CatchupSIMPLE

returns

the 414(v)(2)(B)(ii) SIMPLE Plan Catch-up

Contribution

amount for a given year for a Simple Retirement Account. A catch-up

contribution is an elective deferral made by a participant age 50 or older that

exceeds the otherwise limited amount.

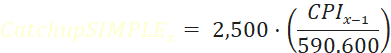

CatchupSIMPLE for year 𝑥 is based on the

following formula:

|

Where 𝐶𝑃𝐼𝑦𝑒𝑎𝑟

is the “3rd quarter CPI” (sum of

the CPI-U for the months of July, August, and September) in the given year.

(September CPI is usual published around October 13.) If the amount so determined is not a multiple of $500,

it is rounded to the nearest multiple of $500. Not less than the amount for

the prior year. The SECURE 2.0 Act of 2022 (“SECURE 2.0”) that was signed into law on

December 29, 2022 as part of the 2023 Consolidated Appropriations Act amended

Code Section 414(v). |

Syntax

CatchupSIMPLE (DeterminationYear, [LawYear],

[Inflation])

|

Parameter Name |

Description |

|

DeterminationYear |

A

4 digit number, or an optional text value as shown in the table below. If the

DeterminationYear is after the LawYear, this is a projected

calculation based on the Inflation assumption. Click to view various options for the DeterminationYear parameter. |

|

LawYear |

A

4 digit number. |

|

Inflation |

The

assumed rate of inflation: the IRS

Cost-of-Living Adjustment for future years, as measured by the

year-over-year increase in CPI-U. This

is used only for a projected calculation. Optional:

default = 0% |

|

Age |

Effective

for 2025 the SECURE 2.0 Act of 2022 added a new provision raising the

catch-up contribution limit for age 60 through 63 (age at end of year). Optional:

default = 50 |