These functions return the dollar amount for the

definition of a “control employee” (non-government employer). Both functions

share the same syntax:

·

Controli returns the compensation amount for the definition of a “control

employee” for an officer under 1.61-21(f)(5)(i).

·

Controliii returns the compensation amount for the definition of a “control employee” for

other than an officer under 1.61-21(f)(5)(iii).

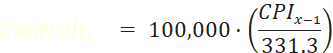

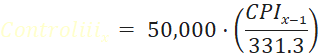

Controli and Controliii

for year 𝑥 are based on the

following formula:

|

Where 𝐶𝑃𝐼𝑦𝑒𝑎𝑟

is the “3rd quarter CPI” (sum of

the CPI-U for the months of July, August, and September) in the given year.

(September CPI is usual published around October 13.) Where

𝐶𝑃𝐼1986

is the sum of the CPI-U for the months of October,

November, December in 1986. (Note that this is 331.2, but a Jim Holland

letter dated 2/4/1993 shows 331.3 as the value used by IRS.) If the amount so determined is not a multiple of $5,000,

it is rounded to the nearest multiple of $5,000. Not less than the amount for

the prior year. |

Syntax

Controli (DeterminationYear, [LawYear],

[Inflation])

Controliii (DeterminationYear, [LawYear],

[Inflation])

|

Parameter Name |

Description |

|

DeterminationYear |

A

4 digit number, or an optional text value as shown in the table below. If the

DeterminationYear is after the LawYear, this is a projected

calculation based on the Inflation assumption. Click to view various options for the DeterminationYear parameter. |

|

LawYear |

A

4 digit number. |

|

Inflation |

The

assumed rate of inflation: the IRS

Cost-of-Living Adjustment for future years, as measured by the

year-over-year increase in CPI-U. This

is used only for a projected calculation. Optional:

default = 0% |