CompLimit

returns

the 401(a)(17) & 404(l) Compensation

Cap annual

compensation limit amount for a given year. For a qualified plan, the

compensation taken into account for any employee in determining plan

allocations or benefit accruals for any plan year is limited to this amount.

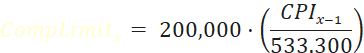

CompLimit for year 𝑥 is based on the

following formula:

|

Where 𝐶𝑃𝐼𝑦𝑒𝑎𝑟

is the “3rd quarter CPI” (sum of

the CPI-U for the months of July, August, and September) in the given year.

(September CPI is usual published around October 13.) If the amount so determined is not a multiple of $5,000,

it is rounded to the nearest multiple of $5,000. Not less than the amount for

the prior year. Note: ·

Prior to 1989 there was no limit. ·

From 1989 through 1993, the limit was $200,000,

indexed for the increase

in 4th quarter CPI (no rounding). ·

From 1994 through 2001, the limit was $150,000, indexed for the increase in 3th quarter CPI ($10,000 rounding). |

Syntax

CompLimit (DeterminationYear, [LawYear],

[Inflation])

|

Parameter Name |

Description |

|

DeterminationYear |

A

4 digit number, or an optional text value as shown in the table below. If the

DeterminationYear is after the LawYear, this is a projected

calculation based on the Inflation assumption. Click to view various options for the DeterminationYear parameter. |

|

LawYear |

A

4 digit number. |

|

Inflation |

The

assumed rate of inflation: the IRS

Cost-of-Living Adjustment for future years, as measured by the

year-over-year increase in CPI-U. This

is used only for a projected calculation. Optional:

default = 0% |