These functions all share the same syntax:

·

SSBend1 returns the first Social

Security Bend Point in the PIA formula for a year.

·

SSBend2 returns the second Social

Security Bend Point in the PIA formula for a year.

Bend points are used in the

formula to calculate the Social Security Primary Insurance Amount (PIA). The

bend points are determined each year based on changes in the National

Average Wage Index.

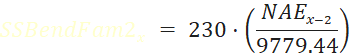

SSBend1 and SSBend2 for

year 𝑥 are based on the

following formulas:

|

The

resulting amount is rounded to the nearest whole number. |

More information can be

found at the Social Security

web site

and here as well.

Syntax

SSBend1 (DeterminationYear, [LawYear],

[WageInflation])

SSBend2 (DeterminationYear, [LawYear],

[WageInflation])

|

Parameter Name |

Description |

|

DeterminationYear |

A

4 digit number. If the DeterminationYear is after the LawYear, this

is a projected calculation based on the WageInflation assumption. |

|

LawYear |

A

4 digit number. Optional;

default = DeterminationYear |

|

WageInflation |

The

assumed rate of increase in the National Average Wage. This

is used only for a projected calculation. Optional:

default = 0% |