These functions share the same syntax:

·

SSSGABlind returns the monthly Social Security substantial gainful activity (SGA) amount for statutorily blind

individuals.

·

SSSGANonBlind returns the monthly Social

Security substantial gainful activity (SGA) amount for statutorily non-blind individuals.

To be eligible for

disability benefits, a person must be unable to engage in substantial gainful

activity (SGA). A person who is earning more than a certain monthly amount (net

of impairment-related work expenses) is ordinarily considered to be engaging in

SGA. The amount of monthly earnings considered as SGA depends on the nature of

a person's disability. The Social Security Act specifies a higher SGA amount

for statutorily blind individuals; Federal regulations specify a lower SGA

amount for non-blind individuals. This amount changes each year with changes in

the National Average Wage Index (NAE).

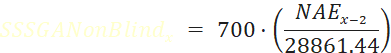

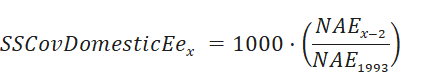

The Social Security SGA amount for year 𝑥 is based on the following formula:

|

The

resulting amount is rounded to the nearest multiple of $10. |

More information can be

found at the Social Security

web site.

Syntax

SSSGABlind (DeterminationYear,

[LawYear], [WageInflation])

SSSGANonBlind (DeterminationYear,

[LawYear], [WageInflation])

|

Parameter Name |

Description |

|

DeterminationYear |

A

4 digit number. If the DeterminationYear is after the LawYear, this

is a projected calculation based on the WageInflation assumption. |

|

LawYear |

A

4 digit number. |

|

WageInflation |

The

assumed rate of increase in the National Average Wage. This

is used only for a projected calculation. Optional:

default = 0% |