These functions share the same syntax:

·

SSCovDomesticEe returns the Social Security coverage

threshold amount for

domestic employees for a year.

·

SSCovElectionWrk returns the Social Security coverage threshold amount for election workers for a year.

A coverage threshold is

an amount of earnings that triggers coverage under the Social Security program.

Earnings below the threshold are not taxable under Social Security nor do such

earnings count toward future benefits. For most wage earners, there is no

coverage threshold; that is, every dollar of wages is covered and taxable. This

amount changes each year with changes in the National Average Wage Index (NAE).

The Social Security coverage

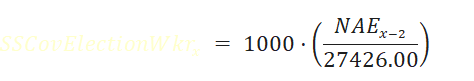

threshold amount for year 𝑥 is based on the following formula:

|

The resulting amount, if not a multiple of $100,

is rounded down to the next lowest multiple of $100. Note: Public Law

103-387 established the domestic employee coverage threshold amounts

for 1994 ($1,000) and 1995 ($1,000) and provided for automatic determinations

thereafter.

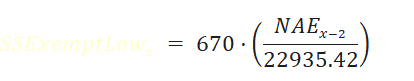

The resulting amount, if not a multiple of $100,

is rounded to the nearest multiple of $100. Note: Public Law

103-296 established the election official and worker threshold

amounts for 1994 ($100) and 1995-1999 ($1,000)

and provided for automatic determinations thereafter. |

More information can be

found at the Social Security

web site.

Syntax

SSCovDomesticEe (DeterminationYear, [LawYear],

[WageInflation])

SSCovElectionWrk (DeterminationYear, [LawYear],

[WageInflation])

|

Parameter Name |

Description |

|

DeterminationYear |

A

4 digit number. If the DeterminationYear is after the LawYear, this

is a projected calculation based on the WageInflation assumption. |

|

LawYear |

A

4 digit number. |

|

WageInflation |

The

assumed rate of increase in the National Average Wage. This

is used only for a projected calculation. Optional:

default = 0% |